OIH-Oil Service Holders

admin on 04 19, 2010

4/19/2010

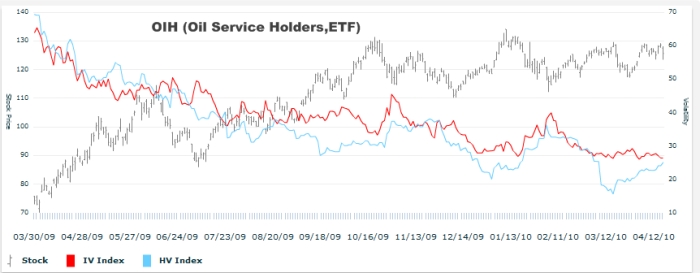

OIH – Oil Service Holders

With the volcanic ash from Iceland causing major problems for the last week OIH has dropped from a high of $129.18 to a low of $123.43 but has managed to close above a 38% retracement level of $124.53. This is the second time that it has bounced from this area. Implied Volatility could be an interesting play here. The ETF price is a little expensive around $125, and the option at the money straddle is currently (May) is currently trading at $7.8. Considering that in the last 3 days OIH has moved almost $6, we don’t expect too much expansion outside of this range. If the the airlines remain grounded then we may see further pressure from low demand, higher inventory, thus driving down oil prices. Most likely we will see things try to get back to some normalcy as the winds shift. This may cause a spike in oil with the “business demand” coming back online. If oil futures do move outside of the range, buying volatility at the top of an explosive chart is always a goo thing. OIH has had trouble staying above $130 in Oct09 and Jan10(high of $134.45). These two sell offs both caused a spike higher in implied volatility. Any inventory shock will cause higher prices that will most likely drive OIH higher as well. We are choosing to trade this one aggressively with gamma trading. As the stock moves higher within the range we will sell some stock against it. As is moves lower we will buy some against the position. This flipping will allow us to offset and hopefully profit for the next two weeks. We will look to exit at profitable areas on either a spike of either side or volatility pop from news or a move.

[private_free]

Update: 4/20/2010

OIH gapped higher and hasn’t looked back. The ATM Straddle that I bought yesterday has expanded to $9.23 on the bid with the OIH trading at $130.63 at 11:17am. I am getting out of the straddle here for a quick profit. Locking in $1.43 or 18% profit in a matter of a few hours is something that you have to do. I have other positions in the oil sector that will continue to profit to the upside.[/private_free]

To see how I traded it, please register below:

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy