AXP Example 11-08

admin on 12 23, 2010

| Business Summary |

|---|

American Express Company provides charge and credit payment card products, and travel-related services worldwide. It offers a range of products and services, including charge and credit card products; expense management products and services; consumer and business travel services; stored value products, such as Travelers Cheques and prepaid products; network services; merchant acquisition, and merchant processing, point-of-sale, servicing and settlement, and marketing products and services for merchants; and fee services, including market and trend analyses along with related consulting services and customer loyalty and rewards programs. The company also publishes luxury lifestyle magazines. American Express sells its products and services to various customer groups, including consumers, small businesses, middle-market companies, large corporations through various channels, such as direct mail, online, targeted sales forces, and direct response advertising. American Express was founded in 1850 and is headquartered in New York, New York.

Trade Notes:

AXP 12/2/2010

We are exiting the position here because our short put spread has come in very nice on the recent bounce. There is no point in waiting for the final $.20 in the puts and if our long calls do not reach $46 then they are worthless.

Buy to Close the Dec 43 Puts for $0.32

Sell to Close the Dec 40 Puts for $0.07

Sell to Close the Dec 46 Calls for $0.44

This locks in profit on entire position of $1.16. Depending on your trade size a 1 lot made $116 whereas a 10 lot would have made $1,160 or 125% return on risk.

11/17

AXP with the recent drop in the stock price and support coming in at the 50 day moving average we are going to buy back the short call to close. We are going to hold the long 46 Call for $0.14 mark today. If the stock does make a quick scamper back higher then we should be able to double this option price and take less of a loss on that call.

Buy to close the Dec 43 Calls for $1.10.

This locks in $0.90 of profit on this short call that we are buying back.

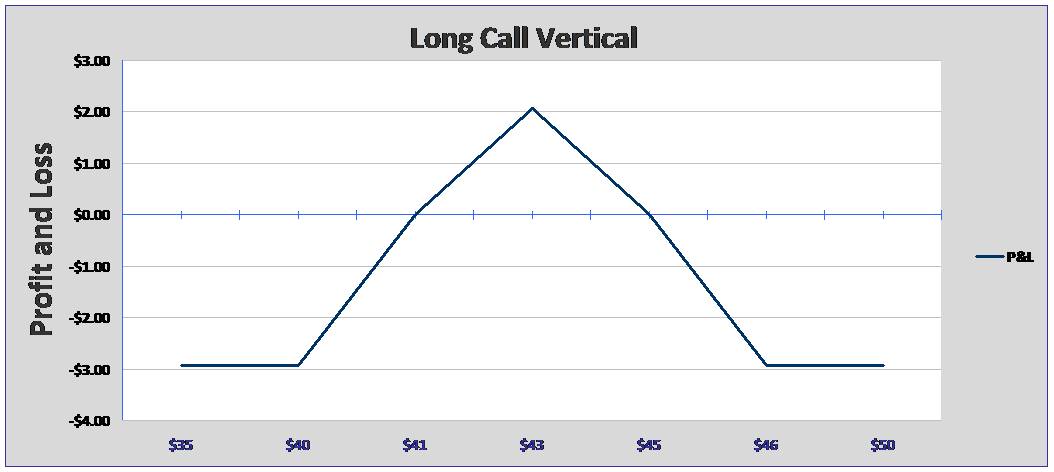

AXP 11/8 New Trade Idea

AXP has been doing pretty well in movement lately where it has gone from mid $37 to a high of $44.27 yesterday. We are going to enter an iron butterfly and we expect a slight pullback for being over bought. It just took out September resistance high of $43.93 and has August resistance around $45. If it starts to move back through the highs then we will exit quickly. If it starts to move lower then we may want to be quick on taking profit on the long call. Support should come in around the September highs right before Sept. expiration around $41.5. We also have the 50 Day moving average just below $41. If it gets down to these levels, then we want to be careful of it breaking below and would want to use a quick stop. If the stock gets to $41, then the spread should still be close to breaking even so we don’t want it to get away from us.

Buy to Open Dec 40 Put $0.42

Sell to Open Dec 43 Put $1.13

Sell to Open Dec 43 Call $2.00

Buy to Open Dec 46 Call $0.64

TRADE GRID

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy