GENZ

admin on 04 18, 2010

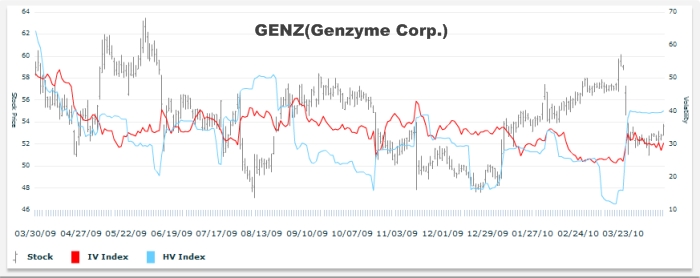

GENZ (Genzyme Corp)

Recently fell from $60.15 to $50.94. Implied volatility popped a little on the stock price drop, but has settled back in. The stock is poised to make a move higher after a nice consolidation in the $54-51 range. Where the options implied volatility index is not the cheapest it has been over the past year for the stock potential movement it is fairly priced. The implied volatility dropped to 24% and the at the money options are now trading at 30%. The positive movement in the stock will drive the implied volatility lower but it should go much lower then the support area around 24%. The stock price appreciation should far offset the decrease in the option’s volatility drop. There are multiple ways to play this depending on your style of trading or favorite strategy.

Results:[private_free]

4/21/2010

With a gap down and then a jam to new highs over $55 we are taking the quick pop to get out of our ATM $52.5 Calls. We were able to get in the May Calls for $2.3 and and after the pullback at the end the day today we are just taking the quick profit. We can sell them for $2.7 on the close. A quick $.40 in two days is a nice trade. If we had ended the day closer to the high we may have tried to ride the position for more gains.

[/private_free]

Register For Free to See the Results

[register_free]

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy