IBM JAN 2011

admin on 12 15, 2010

Back to Portfolio

Business Summary

International Business Machines Corporation (IBM) develops and manufactures information technology (IT) products and services worldwide. Its Global Technology Services segment offers IT infrastructure and business process services, such as strategic outsourcing, integrated technology, business transformation outsourcing, and maintenance. The companyÂ’s Global Business Services segment provides professional services and application outsourcing services, including consulting and systems integration, and application management. IBMÂ’s Software segment offers middleware and operating systems software comprising WebSphere software enabling clients to integrate and manage business processes across their organizations; information management software for database and content management, information integration, data warehousing, business analytics and intelligence, performance management, and predictive analytics; Tivoli software for infrastructure management, including identity, data security, and storage management; Lotus software for collaboration, messaging, and social networking; rational software, a process automation tool; and operating systems, which manage the fundamental processes that make computers run. Its Systems and Technology segment provides computing and storage solutions, including servers, disk and tape storage systems and software, microelectronics, retail store solutions, and semiconductor technology, products, packaging solutions. The companyÂ’s Global Financing segment provides lease and loan financing to external and internal clients; commercial financing to dealers and remarketers of IT products; and sale and lease of used equipment. It serves financial services, public, industrial, distribution, communications, and general business sectors. The company was formerly known as Computing-Tabulating-Recording Co. and changed its name to International Business Machines Corporation in 1924. IBM was founded in 1910 and is based in Armonk, New York.

[private_SwingCreditTrader]

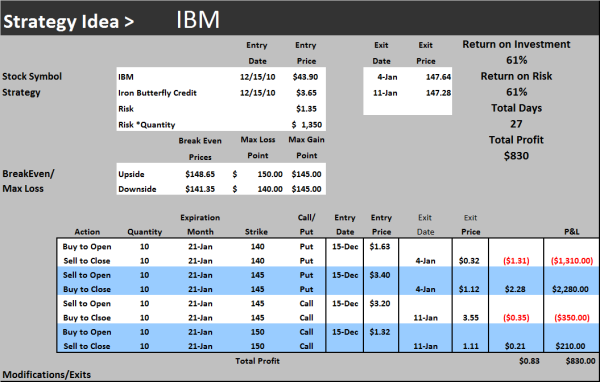

1/11 buy back the call spread for 3.55 on short calls and 1.11 on long calls. This is a $0.14 loss on the call spread, but we have a $.97 profit from the puts spread.$830 Profit of 10 lot spread.

1/4 Buying back the short put spread with the stock near an extreme high. We were able to get the shorts puts back on the close for $1.12 and sell the long puts out for $.32.

This locks in a profit on the puts of $0.97. If the market comes off at all, then we can buy back the call spread, but we have plenty of time for it to decay as well.

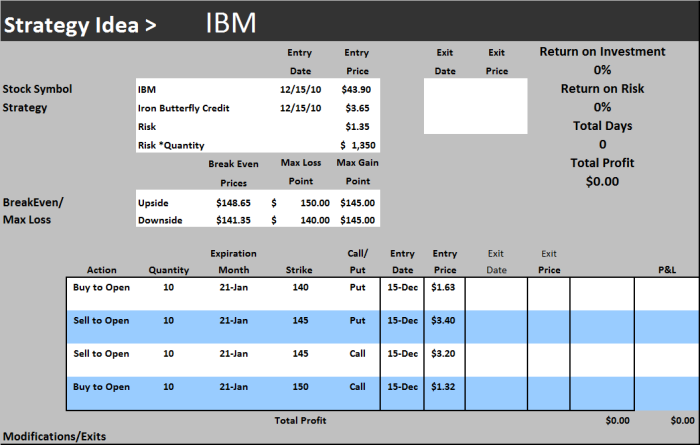

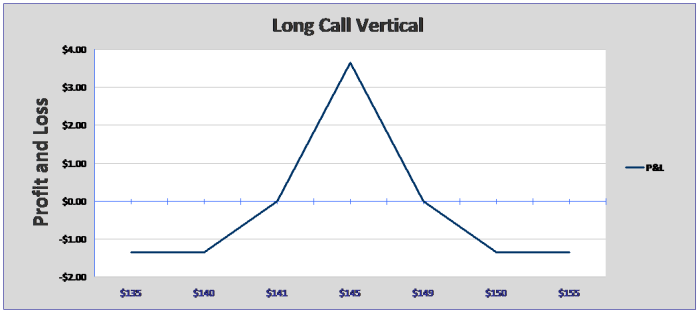

12/15 IBM has been in a nice side ways consolidation. We can also take in a nice premium for the near month vs the outer month for risk reward.We can use the very close support and resistance as for very tight stops or as points of interest to get out attention that a new trend may be starting. Break even on a trade like this are the premium plus/minus in either direction. So if the stock goes up above $148.65 or below $141.35 then we need to consider taking action. Potential actions are to exit the trade completely, take off one side and hope for reversion, further define your stop, or choose to do nothing because you are only risking $1.35 to your max risk point.

Must be logged into view content:

[loginform]

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy