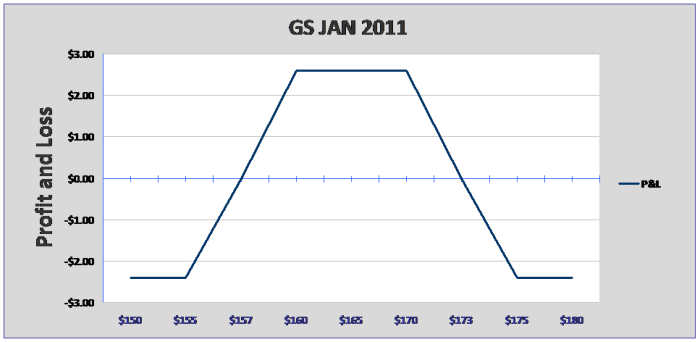

GS JAN 2011

admin on 12 15, 2010

Back to Portfolio

Business Summary

The Goldman Sachs Group, Inc., together with its subsidiaries, provides investment banking, securities, and investment management services to corporations, financial institutions, governments, and high-net-worth individuals worldwide. Its Investment Banking segment offers financial advisory services, including advisory assignments with respect to mergers and acquisitions, divestitures, corporate defense activities, restructurings, and spin-offs; and underwriting services, such as equity underwriting and debt underwriting. The company’s Trading and Principal Investments segment engages in market making in, trading of, and investing in commodities and commodity derivatives, including power generation and related activities; credit products, such as credit derivatives, investment-grade corporate securities, high-yield securities, bank and secured loans, municipal securities, emerging market and distressed debt, public and private equity securities, and real estate; currencies and currency derivatives; interest rate products consisting of interest rate derivatives and global government securities; money market instruments, including matched book positions; and mortgage-related securities and loan products, and other asset-backed instruments. This segment also provides equity securities and derivatives; equities and options exchange-based market-making services; securities, futures, and options clearing services; and insurance services, as well as involves in principal investments activities. The company’s Asset Management and Securities Services segment offers asset management services comprising investment advisory services, financial planning, and investment products; management of merchant banking funds; and securities services, such as prime brokerage, financing services, and securities lending. The Goldman Sachs Group also provides global investment research services. The company was founded in 1869 and is headquartered in New York, New York.

[private_SwingCreditTrader]

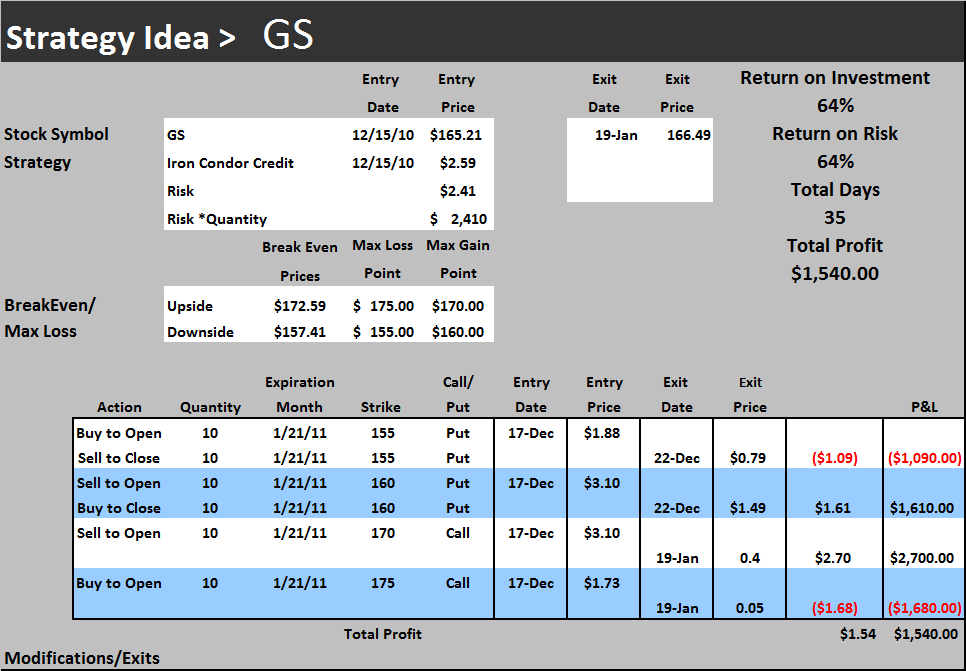

1/19/11 Got lucky and we admit it. Closing down before it rallys. Buy back the 170 calls for .4 sell 175s for .05.

Lock in profit of $1.54 on total trade.

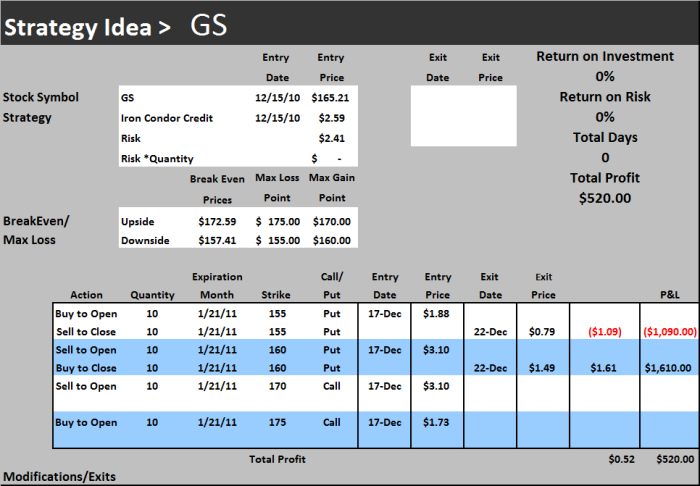

12/22Â Closed the put side down. Locked in .52 Profit

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy