AAPL JAN 2011

admin on 12 15, 2010

Back to Portfolio

Business Summary

Apple Inc., together with subsidiaries, designs, manufactures, and markets personal computers, mobile communication and media devices, and portable digital music players, as well as sells related software, services, peripherals, networking solutions, and third-party digital content and applications worldwide. The company sells its products worldwide through its online stores, retail stores, direct sales force, third-party wholesalers, resellers, and value-added resellers. In addition, it sells third-party Mac, iPhone, iPad, and iPod compatible products, including application software, printers, storage devices, speakers, headphones, and other accessories and peripherals through its online and retail stores; and digital content and applications through the iTunes Store. The company sells its products to consumer, small and mid-sized business, education, enterprise, government, and creative markets. As of September 25, 2010, it had 317 retail stores, including 233 stores in the United States and 84 stores internationally. The company, formerly known as Apple Computer, Inc., was founded in 1976 and is headquartered in Cupertino, California

[private_SwingCreditTrader]

12/28 AAPL

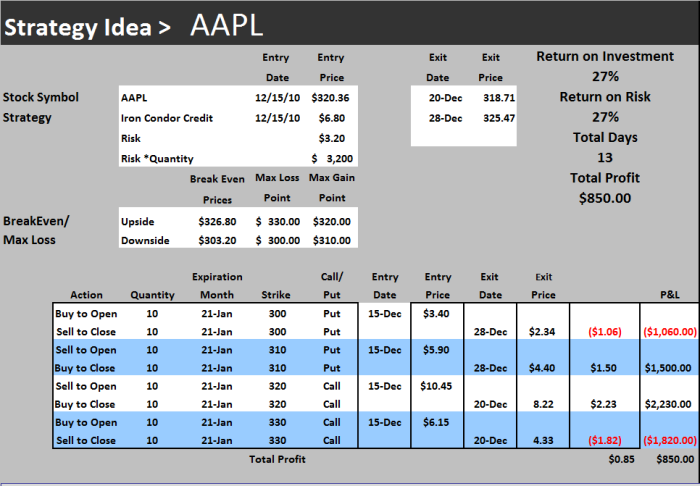

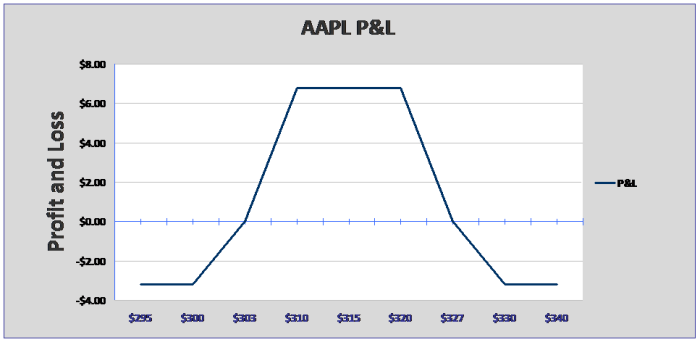

We are closing down the AAPL in front of the next couple potential lucrative days. AAPL may run higher but after the implied volatility spike that we saw this past Monday we want to get out to reduce the risk to the downside. Volatility went from 23.5 on Friday to over 32 on Monday with a major buyer coming in to purchase the 320 -300 put spread. This has hurt our marks, but we still have a profit and don’t want it to get away from us. We can lock in the 310-300 put spread for $2.06 after selling it for $2.5. This is a $0.46 profit on the puts. Total profit on this position is $0.85 cents in 13 days. This is a 27% return on risk. If the stock stays up here with implied volatilities remaining high, then we may re enter the iron condor trade as a package.

12/20 The stock has fallen in a couple of days to 318.23 this morning and our short call spread has decreased so we can buy it back for a small profit of $0.41. The stock should rally back above $320 for testing so we are going to lock this small profit in and hope to get the put spread back when the stock retests the highs.

CLOSING CHART

[/private_SwingCreditTrader]

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy