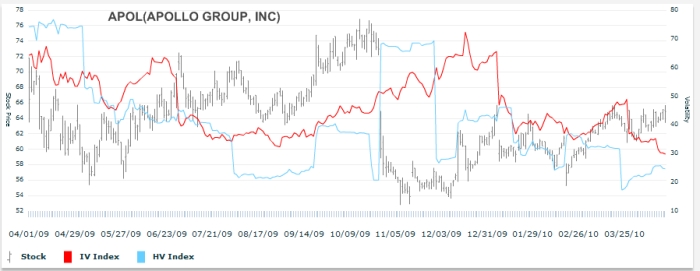

APOL – Cheap IV

admin on 04 21, 2010

4/21/2010

APOL (Apollo Group, Inc.)

The stock has made a nice rebound off of its recent lows at the end of March around $61. Today it took out its high in mid March of $65.69. Volatility is currently on its lows after earnings on 3/29.

Targets / Stops [private_free]

This clears the way for the stock to mover higher to fill the gap after it dropped in Oct09. The low from the top of the gap is $72.16. This provides us a nice target of roughly $7. Stops are a little harder to come by on the chart. On 4/20 the low was $63.4, if the price dropped below here it would mean further retests down to 62 area. Getting down to $63.4 would cut the cost of our atm options in half.[/private_free]

Trade[private_free]

We are going to be a little aggressive here in the option that we buy because even though the vol is relatively low compared to itself, it is still around 30% on a $65 stock. We are also going to be aggressive on the timing of this one, if it does not happen quickly, then we want to get out. If we do not see a continuation through Friday then we are done as well. For this trade we are going long the ATM May 65 calls $2.60. It is high decay position but as long as the stock continues to breakout we could get a nice pop.[/private_free]

Exit [private_free]

4/22/2009

APOL had a quick pop here this morning with the market down pretty big. We just had a failed retest in the stock price reaching $66.5. That is basically up $0.90 from where we got in. The options are now bid $2.9. We are taking our quick gain here, for the fear that this can not hold up given that the market is down. We will look to reload later…if all is well. A quick $0.30 profit never made anyone go broke.[/private_free]

REGISTER FOR FREE MEMBERSHIP

[register_free]

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy