Trade the Markets 8-3-2009

admin on 08 3, 2009

Weekly Comments:

The markets stayed in the “it’s all good†state of mind last week and it looks like they are trying to extend the good feelings into this week judging by the opening indications. We risk sounding like an echo of ourselves but we have to reiterate that this is “thin tradeâ€. Markets are being pushed around in ways that they typically are but with much less effort than is typically required. This has made it possible for “great things to happen†if we judge the amazing returns of this summer to date. As we’ve always said “it won’t take much at all†to get our bullish buddies all “amped up†and indeed it hasn’t. The mere slowing of deterioration and the alluring “greener pastures†of tomorrow that “by law must follow†have apparently done the trick. A great example of this type of attitude can be seen in the revisions. A prudent person would want to be sure that things are “just so†when committing their hard earned capital to investments that entail the risks that stock investing presents. Bulls? Not really as concerned, not in the least. A report came out just in front of the weekend that cited how things were actually much worse than believed in the past if measured by the NOW REVISED government reports that are available. Now, while this is not always the case, it is normally the case and if you don’t believe that the government tries to cast everything in the best light for its political goals then you haven’t been following things very closely for the past quarter century. And these types of episodes have been one of the reasons why we’ve been trying to impart to readers that we’ve found it best to avoid trying to make sense of it, or in other words, ignore the cognitive dissonance in terms of trading but stay apprised in terms of investing. A report is out from the New York Times that will help in this area (via Marketwatch):

Unemployment benefits to dry up for 1.5 million: NYT

Up to 1.5 million unemployed workers are set to lose their jobless benefits by the end of the year, according to a media report Sunday.

As many as 500,000 unemployed are estimated to use up their benefits by the end of September, the New York Times reported in its online edition, citing statistics compiled by the National Employment Law Project.

According to the statistics, 31 states have three-month average unemployment rates of more than 8% with 400,000 jobless workers losing benefits by the end of September. In 13 states and the District of Columbia which have unemployment rates of more than 10%, about 230,000 workers are set to lose benefits by the end of September.

About 9 million Americans currently are collecting unemployment insurance, according to the Times.

AND …At nearly the same time from :

2 Obama officials: No guarantee taxes won’t go up

2 Obama administration officials can’t guarantee middle-class Americans won’t see tax hike

WASHINGTON (AP) — President Barack Obama’s treasury secretary said Sunday he cannot rule out higher taxes to help tame an exploding budget deficit, and his chief economic adviser would not dismiss raising them on middle-class Americans as part of a health care overhaul.

As the White House sought to balance campaign rhetoric with governing, officials appeared willing to extend unemployment benefits. With former Federal Reserve Chairman Alan Greenspan saying he is “pretty sure we’ve already seen the bottom” of the recession, Obama aides sought to defend the economic stimulus and calm a jittery public.

Treasury Secretary Timothy Geithner and National Economic Council Director Larry Summers both sidestepped questions on Obama’s intentions about taxes. Geithner said the White House was not ready to rule out a tax hike to lower the federal deficit; Summers said Obama’s proposed health care overhaul needs funding from somewhere.

Aside from potentially channeling G. Bush 1 in terms of possible noteworthy tax pledge breaks, this is potentially big news when actually 3 top administration officials mention this on the Sunday morning propaganda push. Our guess is that funding issues and thus deficits may actually have Washington concerned at least momentarily. But rest assured that everything is getting better even though none of us general public types can really tell. You see, D.C., Wall St., and notably Alan Greenspan have all assured us in some way that “it’s all good†now or it will be shortly. Can you think of 3 more reliable or trustworthy sources? We’re about to extend those unemployment benefits because things are improving so dramatically?

What’s actually happened is that corporate America and the corporately owned media and the corporately owned government have done their thing. They’ve got things marching back in the opposite direction and the spin apparatus will do everything that it can to convey that to us general public types. That’s why it’s possible for there to be a bid under the market all day long, all summer long and that’s exactly what there has been if you’ve watched it as we have. A bid that doesn’t take a breather because it has to work so hard to convince us all that things are improving, “why just look at the marketâ€! But it is doing so at the opportune time and in “new†technical territory which helps. BUT, trying to make sense of all of this in real-time is nearly impossible. You can’t wait around because, trust us, the bulls won’t wait around for any of it to be true or let alone make sense. Many of them believe that a rally must follow a selloff and that an expansion must follow a contraction. “It’s always been so. It must be so.â€Â That’s the playbook that’s worked for them for quite a long time but in the aftermath of the popping of this latest epic bubble we’re still hard pressed to really buy into it. And that is despite the fact that several factors are already in place to make reports and statistics appear to be improving over the next few quarters far more impressively than is likely to be the case. Corporate America has played the quarterly game well but they were enabled to do so as expected. They’re now running very lean thanks to massive cost cutting but where is the real growth going to come from? How much more cutting is possible and what effects will it have on the economy? With the incomprehensible expansion of the monetary base should we be surprised to see price spikes at all, anywhere, especially in stocks? Probably not. That’s what makes it so difficult at times like these. In the long run (investing) more of the nonsense can be discounted but in the shorter run (trading), we know that the gamesters can get away with a lot, nearly all of it for a good long while. Thus it follows that the markets can be taken on one hell of a joyride for much longer than most would believe, regardless of how dangerous it looks from afar. Stay nimble.

.

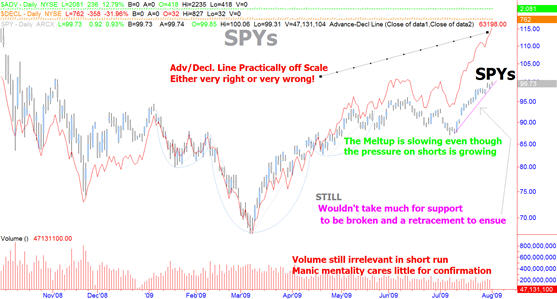

The Technical Picture:

“This chart is labeled and has accompanying commentary within it. Our intuition tells us that this was the boys doing what they do best: Using the convenient news to rake pattern traders and those expecting a correction over the coals. The volume levels suggest less than impressive buying or adding by institutions but this is a wildcard at the moment considering that we’re near the Heart of the Summer trading at the moment. Assuming as we did in our comments above that trading profits are paramount, nothing can be ruled out volatility-wise despite our macro-picture based cynicism. Another stage of what would be an epic short squeeze could trigger if the head is blown through and a retracement could easily occur given the slope of last week’s yeoman’s work by the boys. We’re trading it that way until we have greater technical conviction.â€

Those are the exact comments that we made from last week. We’re staying with them as they still apply. The chart is updated however with new comments. This is truly historic and we think that has been made possible by the computationally enhanced performance chasing combined with modern pipes and of course the always presented hyperinflated monetary base. They’ve got a lot of institutions all “ginned up†and they’re keeping their foot on the accelerator pedal. It has to be excruciating for those that not only want to get in but have to get in to keep their jobs and investor’s funds. Push anything long enough and hard enough and you can force the hand of most people. We saw the same thing but in the opposite direction over the winter when forced liquidation was only game in town.

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy