Buy Low Sell High

admin on 04 21, 2010

This is the one of the oldest stock market phrases that is repeated without ever truly understanding it. Brokers will repeat it to their customers and traders use it to joke around. On the most basic core level it is the terms for the average person that when you buy anything of value you want it to increase in value so that you can sell it at a higher price than you purchased it for. This is the “objective” for most investment assets. Some assets are depreciating assets in that the value decreases over time..your average automobile. Once you drive it off the lot it depreciates or loses value. Every extra mile it should theoretically lose value. Other assets like your home fluctuate in price with the market. Your home can be considered a depreciating asset but at a much slower pace. The life of a house depends on the construction quality, weather and maintenance. The price of the house will increase or decrease with supply and demand. The higher the demand the higher the price. The less supply the higher the price. We are seeing higher supply these days so prices are dropping. The economy has been in poor shape, so there is a lack of demand, so this is also forcing prices lower. So as the supply and demand increase and decrease so does the home prices.

This is the one of the oldest stock market phrases that is repeated without ever truly understanding it. Brokers will repeat it to their customers and traders use it to joke around. On the most basic core level it is the terms for the average person that when you buy anything of value you want it to increase in value so that you can sell it at a higher price than you purchased it for. This is the “objective” for most investment assets. Some assets are depreciating assets in that the value decreases over time..your average automobile. Once you drive it off the lot it depreciates or loses value. Every extra mile it should theoretically lose value. Other assets like your home fluctuate in price with the market. Your home can be considered a depreciating asset but at a much slower pace. The life of a house depends on the construction quality, weather and maintenance. The price of the house will increase or decrease with supply and demand. The higher the demand the higher the price. The less supply the higher the price. We are seeing higher supply these days so prices are dropping. The economy has been in poor shape, so there is a lack of demand, so this is also forcing prices lower. So as the supply and demand increase and decrease so does the home prices.

The supply and demand factor has the same effect on the stock market. People buy and sell shares of a company based on the idea that the company will make money and supply a dividend or reinvest in the company itself making it worth more. Every stock moves up and down and is often correlated to the overall market. So when the broader market increases then the stock increases. There are too many forces to go into on what drives a stock price but the basic concept is that it does increase and decrease in price. When we talk about buying low and selling high we talk about buying when the stock is at a low price and obviously selling when it is high. The fact is that this is what makes the market what it is. Who is to say today that your favorite stock is low in price and in position to buy?

Fundamental analysts will tell you based on research that the stock is over/under or fairly priced. They use balance sheets, earnings, dividends, competitor analysis, and industry analysis, etc. Technical analysis will use the history of the stock plotted on a chart to see where the stock is in relation to itself in the past. There is no exact right answer or formula for knowing when it is the right time to buy…thus the market.

If you buy low and it does lower what do you do? If it goes higher and you fail to sell, what do you do? These are basic questions of money management but things that every investor trader needs to reconcile before they get into an investment.

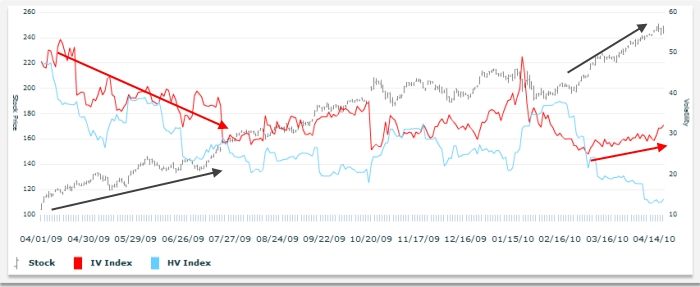

I use sound fundamental companies and then use several technical analysis indicators to help me find stocks that I think are undervalued or under priced. Valued is fundamental and priced is technical.   I then use options to take advantage of the movement that I think the stock is going to have. There is the buy low sell high characteristic here as well. You should never buy over priced options (high implied volatility) unless you are extremely confident in your stock target. You are ideally buying cheap low priced options (low implied volatility). Unfortunately, this is not always the case. Often times we have to buy options at fair value(mid volatility levels) in order to take advantage of the stock opportunity. The best case scenario is finding a good stock opportunity with cheap options( low implied volatility).

The true power of options allows you to trade in both directions. You can make money if the stock goes up or down or both with the right strategy. So combining the direction and the cheap options allows you to both buy low or sell high. This is why most brokers don’t get this simple saying. I think there is so much more to it. As a option investor/trader we have the ability to buy low and sell high. The vast majority of brokers do not understand options let alone recommend them. Options are a little complicated to learn, but once you do it opens a whole new world of opportunity.

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy