Week Ahead 06-29

admin on 06 29, 2010

Well first I have to apologize for taking a much needed break after being sick. My wife and I celebrated our 12th anniversary on Sunday. There is a ton of things that have happened in the past week and half that I could write about, but they all seem so dreary. It seems are news driven market has ebbed and flowed with no real rhyme or reason. We have rallied from the 2nd week of June from $105 in the SPYs to pop just after expiration of $111.41. This may not seem like much of a move, but given the current environment, I will take anything I can get. As for our sell off from recent highs to our current low on Friday of $106.77, it seems the market just needed a sell off. It went up on nothing and last week was a lousy week for news. Basically there were more signs that our “great” recovery is not as great as they (talking heads on CNBC) have tried to make us believe. I have not been able to find much positive news for several weeks. In fact more people are jumping on the bandwagon that there is no solution to our global problem of over spending and over inflating for decades. Most people continue to look for their handout from big government. it could be through unemployment, social security, medicare/medicaid or government pensions.

Generations ago the popular belief was that you worked for a company and they took care of you for life. This is usually meant medical coverage and a pension. Clearly this system was doomed to fail as the company got older and older and their workers continued to age. The model completely broke. The average age of a worker has steadily increased over time with improvement in health care and medical detection equipment. This has thrown off calculations years ago of how long the average worker would last and the cost of the insurance and pension for their extended lives. This same problem seems to happen to our government with naive calculations and never stress testing a situation.

Just like this past medical legislation that passed, the numbers that the calculations were built from were just simply wrong. Congressional Budget Office numbers can never be trusted because they usually take a conservative estimate and never give a worst case scenario. As traders we need to understand our risk and probability of future events happening. By passing legislation with no way of stopping the future hikes in medical insurance this bill is basically a big fat negative to every middle class worker. It will only result in higher medical costs that will crush the middle class. The next several years as more of the bill is enacted the more pain and medical premium increases we will see. If the CBO truly wanted to give Congress and the public some real figures they could have. Double counting and having to back out programs doesn’t do anyone any good. I would love to see some stress tests on their variable projections. Inflation increases, medicare cuts, medicaid cuts, lack of doctors, insurance premium increases across all of these variables and projected costs to a government trying to reduce a deficit. Any person in their right mind would not have voted for it, but who said Congress and the Senate were in their right minds.

Since the world has become a global economy, we have never faced a situation like the one that we are facing now. We have never faced decades of overspending and living beyond our means by so many separate countries. The news points clearly to the countries that have overspent the most, but that doesn’t mean that others are not guilty. The US is trying to hide their balance sheets, but Europe is acting like a tattle tell kid that got caught doing something they shouldn’t. It seems they are trying divert attention from their own balance sheet and pointing to the US deficit ratios. The attention has only hurt these countries. The more investors see the very low probability of any of these austerity and bailout measures from truly working the more they demand for higher rates of return in exchange for risk.

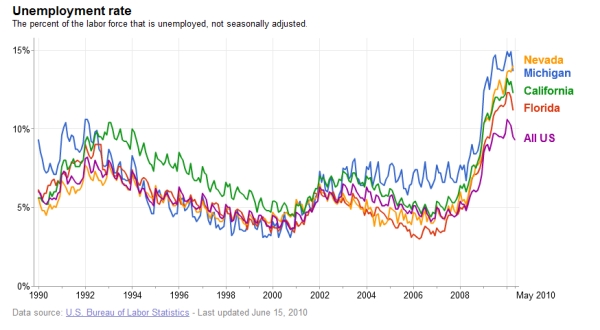

Beware of unemployment numbers. ADP should give some incite into Friday’s jobs number.

Some reports are calling for unemployment rates to be as high as 10.5% for July’s forecast as people are forced off of the unemployment benefits.

So much for a slow summer!

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy