More Economic Stumbling Points

admin on 06 17, 2010

Even though the talking heads on CNBC are saying that our economy is back on track and that everyone should stop worrying it, the news that came out today should have everyone paying attention.

Some of the major news out today that I wanted to highlight:

- More than 90 U.S. banks and thrifts missed making a May 17 payment to the U.S. government under its main bank bailout program.

- “Factory activity growth plummeted in the U.S. Mid-Atlantic region in June, a survey showed Thursday, adding to worries that the short and tepid U.S. economic recovery is now fizzling.-APÂ The Philadelphia Federal Reserve Bank said its business activity index dropped to 8.0 in June from May’s 21.4.”

- WASHINGTON (AP) — The number of people filing new claims for jobless benefits jumped last week after three straight declines, another sign that the pace of layoffs has not slowed.

- Home builder stocks lost ground a day after luxury home builder Toll Brothers Inc (TOL) said a decline in consumer confidence has led to fewer people looking to buy a home. Its shares declined 3.9 percent to $18.04 while KB Home (KBH) fell 2.6 percent to $12.60.

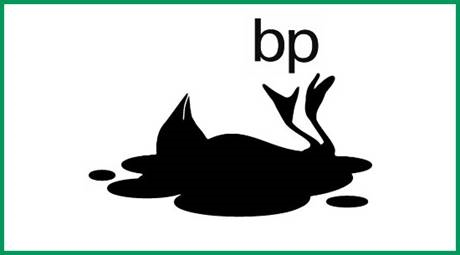

- Oil still gushing in Gulf.

- Fed Ex warns of tougher times ahead.

- Idiots bought BP stock because of a 20B fund creation which does not limit BPs liability. BP also suspended their dividend for the next three quarters which will put further pressure on the stock. Not sure why anyone would want to touch this stock unless you are buying puts.

This economy is far from out of the woods. In fact, only by government defined numbers have we come out of recession. The economists are having a tough time forecasting the future because on one hand there are positive corporate earnings and on the other hand everything is crap:

- Housing is crashing

- There are no jobs

- Foreclosures are increasing

- Fed is pushing out dollars why the failing banks are trying to hoard them

- The European Union is a farce and the individual countries are facing widening spreads on their debt.

- Our government’s deficit is out of control and there is no way to stop it!

- Our government is now trying to use this gulf crisis to push the cap and trade bullshit.(rahm emmanuel…never waste a good crisis!)Â Huge cost to US taxpayer!

There are just too many negatives vs the very few positives. If you want to keep believing CNBC then I wish you all the luck in the world.

I hope you are paying attention to the real news.

How many species may become extinct from this spill? How do you put a price on that? Just something to think about. Report on CNBC tonight on Kudlow that internal documentation said that there was a 99% chance that there would be a single pipe lining failure within the 40 year lease period. Not sure how you get past that number!

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy